And, the particular exemption may drive certain PPM requirements because certain exemptions require certain types of information disclosure.

#Private placement memoranda registration

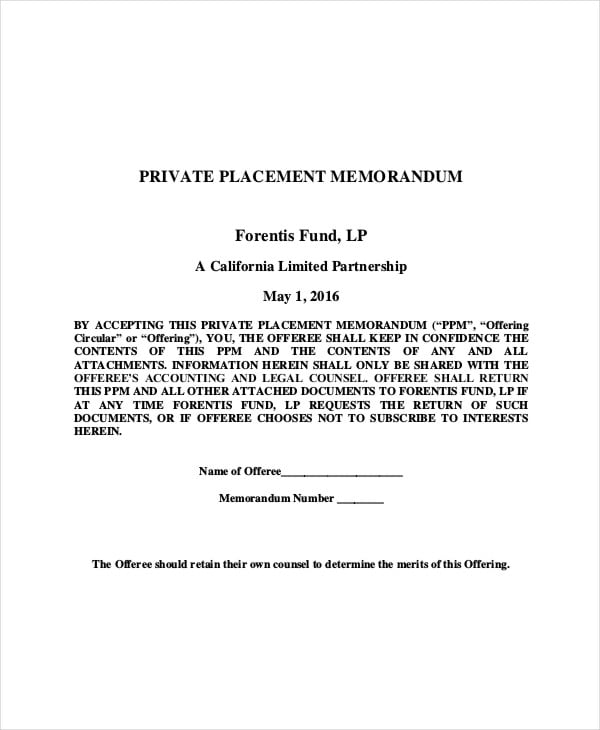

laws), you must ALWAYS have an exemption from registration or you must register the securities with the SEC before issuing them. This a topic for another article, although for now you should know that, whenever you issue securities in the U.S. The rest of this article assumes that your company qualifies for one of several exemptions that allow you to avoid Securities and Exchange Commission (SEC) registration for the securities you will issue. The balance ought to weight toward compliance (mitigating risk), but you (and your lawyers) can’t ignore the importance of producing a document that encourages investors to invest! There are plenty of ways to do this while still protecting your company and yourself from undue risk. They are, which makes creating PPMs an exercise in balance. You may recognize that compliance and marketing are very different goals. They are meant to act as both a compliance and marketing tool. Private placement memorandums-or PPMs-serve a dual purpose. This is helpful if you want to do some of the PPM work yourself or just to understand the type of information an investor ought to receive and information about which investors may have questions.

#Private placement memoranda series

There are certain industries and situations where PPMs are rare (e.g., technology startups – seed stage, Series A, even later stages that are raising money from angel investors and venture capitalists) and others where they are the norm and expected (e.g., restaurant and real estate offerings).Īs you consider the value and need for a PPM in your specific situation, you may be asking yourself, “What goes in a PPM?” The information in this article is intended to help you understand more about the substance and purpose of private placement memorandums. The decision of whether you should use a PPM is rarely simple, although together we can figure out what makes sense given the context in which you are raising capital (i.e., the use of the capital, targeted investors, amount of money you are looking to raise, your budget, expectations of investors regarding documentation – what’s “typical”, etc.). If you aren’t certain if you want or need to use a PPM, start by reading Do I Need a Private Placement Memorandum (PPM) to Raise Startup Money?. When raising capital, many of these owners and entrepreneurs decide they should (or need to) go the route of using a private placement memorandum (PPM) to inform potential investors about the structure of their business, the investment opportunity, and the risks associated with both. I spend a lot of my securities law practice advising savvy startup owners and seasoned entrepreneurs on the most effective methods for structuring their companies in a way that both satisfies the law and positions their businesses to successfully raise investment capital.

0 kommentar(er)

0 kommentar(er)